AgentLayer: World's Autonomous AI Agent Blockchain

I. Introduction

With the rapid advancement of generative AI powered by large language models (LLMs), autonomous AI agents are positioned to be the next significant shift in artificial intelligence, heralding a new era in computing platforms.

Autonomous AI agents are reshaping industries and professions by enhancing productivity, innovation, and overall well-being through their autonomous capabilities. These intelligent systems operate independently. They are not just tools but active collaborators in the creative process, driving innovation and efficiency across various sectors. The market trajectory for autonomous AI agents indicates significant growth, reflecting their value in streamlining operations and fostering a new era of business efficiency.

The integration of AI with decentralized systems in the Web 3 era offers opportunities for enhanced decision-making and increased transparency while ensuring data integrity, security, and trust in AI applications by leveraging blockchain's decentralized and immutable ledger. Autonomous AI agents coupled with decentralized AI governance represent a significant advancement in artificial intelligence that has the potential to transform industries while ensuring responsible development and ethical use of AI technologies. Many crypto luminaries, such as Vitalik Buterin, co-founder of Ethereum, advocate for the integration of AI and blockchain. By combining AI and blockchain, Mr. Buterin believes that new applications and opportunities can be unlocked, revolutionizing how systems operate on a micro-scale.

Autonomous AI agents represent a significant milestone in artificial intelligence advancement, automating tasks that traditionally required human intervention, leading to increased efficiency and productivity. These agents process vast amounts of information to identify patterns, extract insights, and make contextually appropriate decisions beyond rule-based approaches. On the other hand, human oversight is crucial to balance agent autonomy, ensuring performance, reliability, and ethical operation. Integrating human oversight in the operational framework enables businesses to maintain a balanced and ethically sound autonomous operation.

AgentLayer, a pioneering protocol and public blockchain leveraging the powerful OP Stack, is designed to facilitate the coordination and collaboration of autonomous AI agents with human oversight in a permissionless, secure, and reliable manner. It stands out as the world's first decentralized network for autonomous AI agents, leveraging a Byzantine fault-tolerant blockchain to establish a decentralized registry of AI Services, Agents and Models. Additionally, AgentLayer introduces a new AI currency ($AGENT) to fuel an innovative AI-powered Agent Economy on the blockchain, enabling the minting, deployment, and swapping of AI assets on-chain.

The economic model of AgentLayer is structured around $AGENT tokens, serving as the primary transaction medium and reward system within the network. These tokens play a crucial role in incentivizing participants like agent developers, model developers, node operators, investors and end users to collectively uphold the network ecology. Various economic activities within the network, such as agent service fees, node rewards, protocol revenue, and AI assets’ minting, deployment and transactions, are settled in $AGENT tokens. This mechanism ensures the circulation of value and ecological balance within the AgentLayer network.

AgentLayer enables and promotes multi-agent collaboration through AgentLink, a suite of protocols designed to enable agents to work together to complete tasks. This is achieved by seamlessly facilitating the exchange of information, commands, and results, as well as by sharing incentives. AgentLink distinguishes itself as a groundbreaking tool that bridges the specialties of various AI agents, fostering synergy and significantly boosting their abilities and flexibility in tackling a wide range of tasks. This innovative approach not only enhances the individual capabilities of AI agents but also leverages their collective strengths, enabling them to efficiently address more complex and varied challenges. We envision building the workforce of the future with AgentLink, laying a strong foundation for a world increasingly driven by AI agents.

Decentralized AI governance plays a crucial role in managing AI systems responsibly and reducing the risks associated with centralized systems monopolized by large corporations. By distributing decision-making authority among stakeholders using blockchain technology, decentralized AI governance promotes transparency, trust, and inclusivity. It empowers users by giving them control over their data and fosters innovation by allowing developers to experiment with AI algorithms to create their proprietary agents.

In summary, AgentLayer's innovative protocol not only revolutionizes the coordination of autonomous AI agents but also sets a new standard for decentralized governance in the realm of artificial intelligence. By combining cutting-edge technologies like blockchain with AI capabilities, AgentLayer paves the way for a more efficient, collaborative, and responsible ecosystem for autonomous agents.

II. AgentLayer’s Protocol Overview

Components

AgentLayer is a cutting-edge protocol that facilitates the collaboration of autonomous AI agents through various functional components. These components include:

AgentNetwork: Purpose-built for Decentralized AI Agents, designed with a high-performance Ethereum layer-2 network, modular architecture, and strategic alignment facilitated by the $Agent token.

AgentOS: A zero-code AI Agent development and orchestration framework for seamless agent deployment.

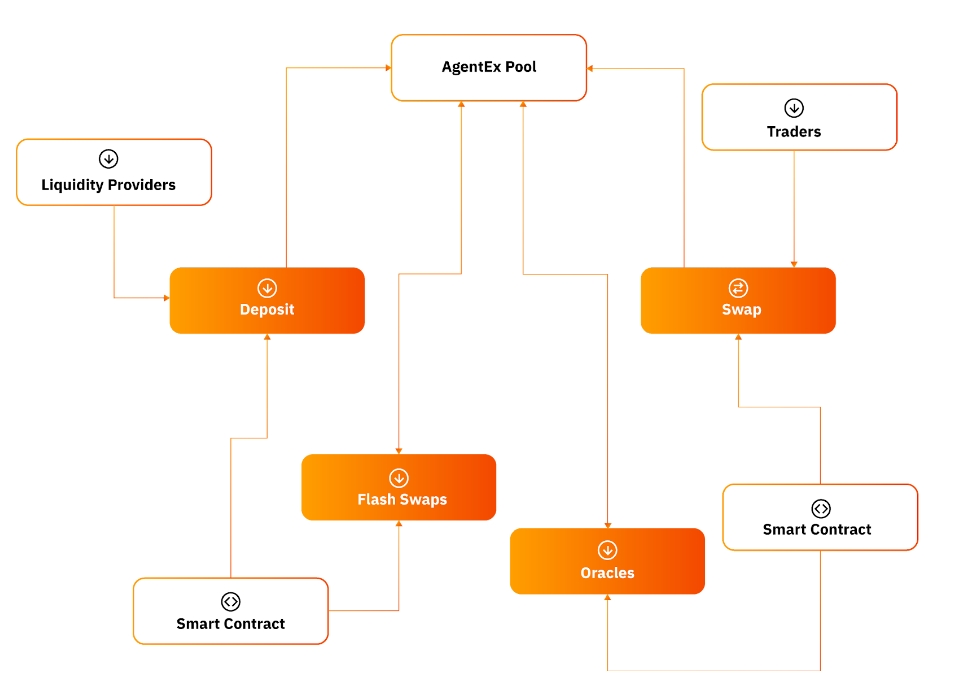

AgentEx (AgentFi & Agent Store): A gateway for discovering and investing in AI Agents.

AgentLink: A set of protocols enabling agents to communicate, collaborate, and share incentives with other agents.

ModelHub: Curates collections of open-source State-of-the-Art Language Models (LLMs) for building agents, including the proprietary TrustLLM.

Technical Architecture

This project follows a modular approach, dividing the technical architecture into three levels of modules: AgentNetwork, AgentOS, and AgentEx. These modules are designed to streamline the implementation process and enhance the functionality of the system.

The AgentNetwork layer serves as the physical execution environment for agents, encompassing multiple AgentLink contracts, distributed ledger infrastructure, and basic chain by Op stack + EigenDA. It plays a crucial role in achieving consensus and verifying agents' actions, as well as establishing a protocol for interoperability among multiple agents. This layer facilitates communication and incentivizes positive interactions among agents. The AgentOS layer includes development suites, orchestration tools, and services for multiple agents. It offers various foundation models such as Mistral, Llama, and proprietary TrustLLM for fine-tuning capabilities. The uppermost layer AgentEx is the gateway to discover and invest in a variety of AI agents powered by the AgentLayer protocol. One of the unique features of AgentLayer’s protocol is to facilitate the minting and trading of agent as assets, called AgentFi. AgentFi supports developers to register and release proprietary agents on AgentEx (Agent Store).

AgentNetwork Layer

The AgentNetwork is purpose-built for Decentralized AI Agents, designed with a high-performance Ethereum layer-2 network, modular architecture, and strategic alignment facilitated by the $Agent token.

Basic Environment

The basic environment serves as the runtime environment for AI Agents, encompassing data storage, a container engine, prompt generation framework, integration with multiple LLM APIs, and engines for interacting with and accessing data on the blockchain. This environment provides the necessary infrastructure for AI Agents to function effectively within the system.

Container Engine: The container engine provides AI agents with an isolated and independent execution environment, responsible for initiating, terminating, and managing containerized applications. It ensures the seamless operation of these applications across diverse operating systems and hardware setups. Containerization is a pivotal technology in contemporary cloud computing and microservices architecture, facilitating swift deployment and scalable services.

Base Container: The standardized runtime environment for AI Agents is provided by the base container, which specifies the essential requirements for running AI Agents, such as the operating system, libraries, and dependencies. This standardization ensures compatibility across different platforms and enhances the portability of Agents within the system.

AgentLayer SDK: The AgentLayer Development Kit (SDK) empowers AI Agents to engage and conduct transactions on blockchain networks. Within the basic environment, a variety of Web3 SDKs tailored for different programming languages are available, enabling Agents' developers to interact with the Agentlink protocol and the Agent AVS seamlessly. This functionality allows Agents to perform Agent call、smart contract calls, handle transactions, and access blockchain data effectively.

Blockchain Data: Direct access to blockchain data within the environment layer includes transaction history, ledger states, and smart contract states. This access is vital for AI Agents to verify the integrity of transactions and operations effectively. It ensures that Agents can securely interact with and validate data on the blockchain, enhancing transparency and trust within the system.

Basic Prompt Framework: The component in question provides a standardized set of interfaces or templates for generating and processing AI Agents' prompts. These prompts are crucial for natural language processing, enabling Agents to comprehend and respond to user requests effectively. The prompts typically consist of components like requests, framing context, format specifications, and references to enhance the interaction between users and AI Agents.

LLM API: The API for Large Language Models (LLMs) integrates various LLM programming interfaces, including TrustLLM, enabling AI Agents to undertake more complex multimodal tasks. Through LLM APIs, Agents can engage in sophisticated tasks that involve interactions with diverse models and services. This integration enhances the capabilities of AI Agents, allowing them to perform a wide range of functions beyond traditional text-based interactions.

AgentChain

AgentLayer utilizes the OP Stack and EigenDA to create AgentChain, a public blockchain that enhances coordination and collaboration among Agents powered by the AgentLink protocol. This blockchain facilitates contracts and trading logs between Agents, offering an Agent OP Sequencer to enhance the collaborative network of Agents. Through innovative protocols like AgentLink, AgentLayer enables multi-agent collaboration by facilitating communication, task completion, and incentive sharing among Agents. This approach not only boosts individual AI agent capabilities but also enhances collective efficiency in addressing diverse challenges, laying a strong foundation for a future driven by AI agents.

The OP Stack is like a toolbox that powers Optimism and other rollups, providing essential components like sequencers, nodes, and contracts. It can be used independently to support different rollup implementations. In its default setup, the OP Stack relies on Ethereum for Data Availability (DA), storing L2 transaction batches on Ethereum for security. This setup ensures a secure and reliable L2 chain but also has some limitations.

Using Ethereum for Data Availability (DA) means that Ethereum's strong security protects the data, keeping the system relatively simple. However, Ethereum's calldata is costly and has limited capacity. Before EIP-4844, Ethereum's consensus throughput was restricted to 200kb per block every 12 seconds, which was insufficient for the scaling needs of the decentralized web.

Execution throughput was historically the primary bottleneck for Ethereum's scalability, leading to the emergence of rollups as a solution. However, as rollups have evolved, Data Availability (DA) throughput has become the new limiting factor.

To address this challenge, integrating best third-party DA services like EigenDA into the sequencer network DA layer can overcome this obstacle. By writing L2 transaction data to a secure and scalable DA Operator set, rollups can achieve unprecedented scalability, paving the way for new possibilities in the decentralized web.

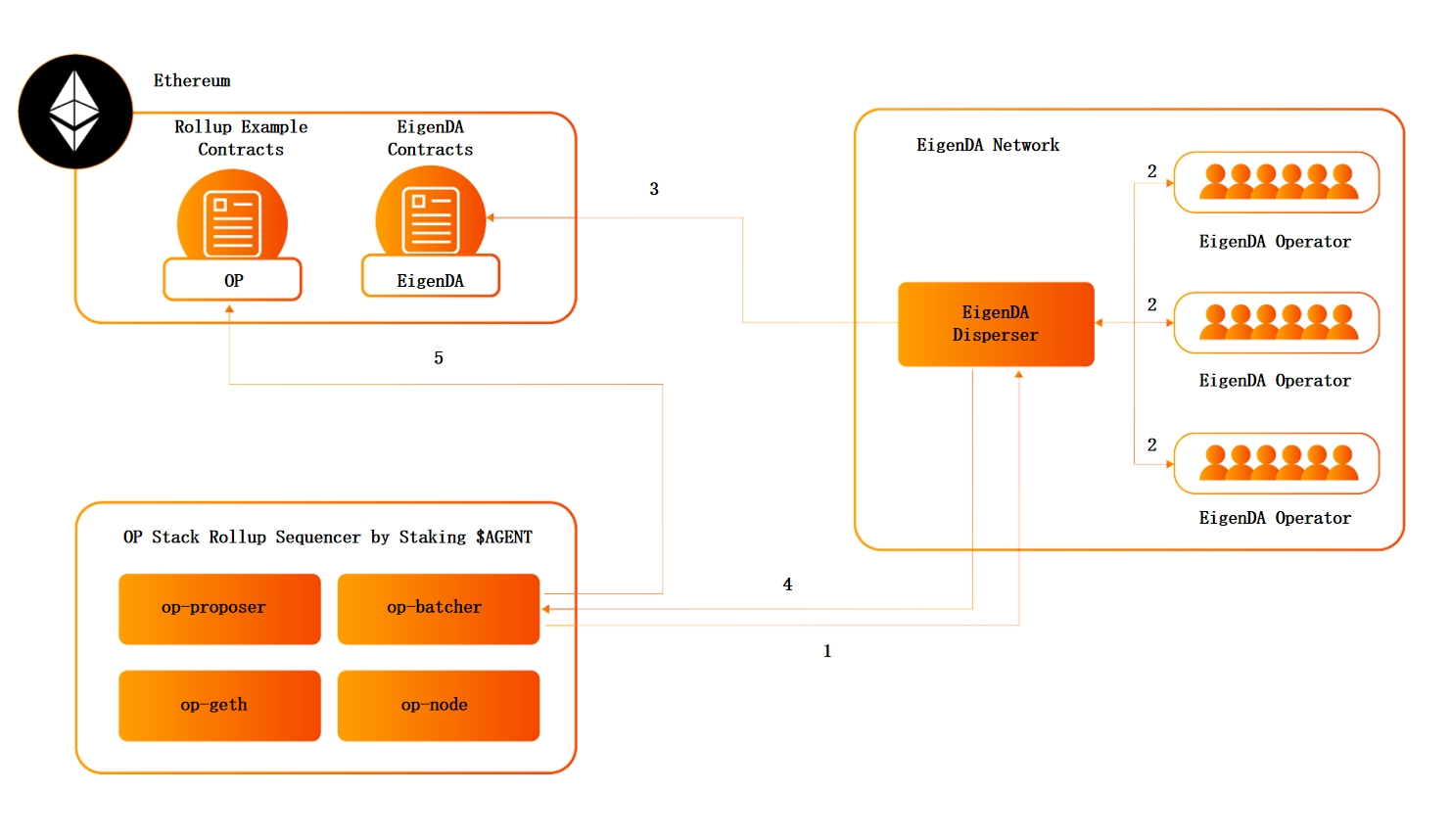

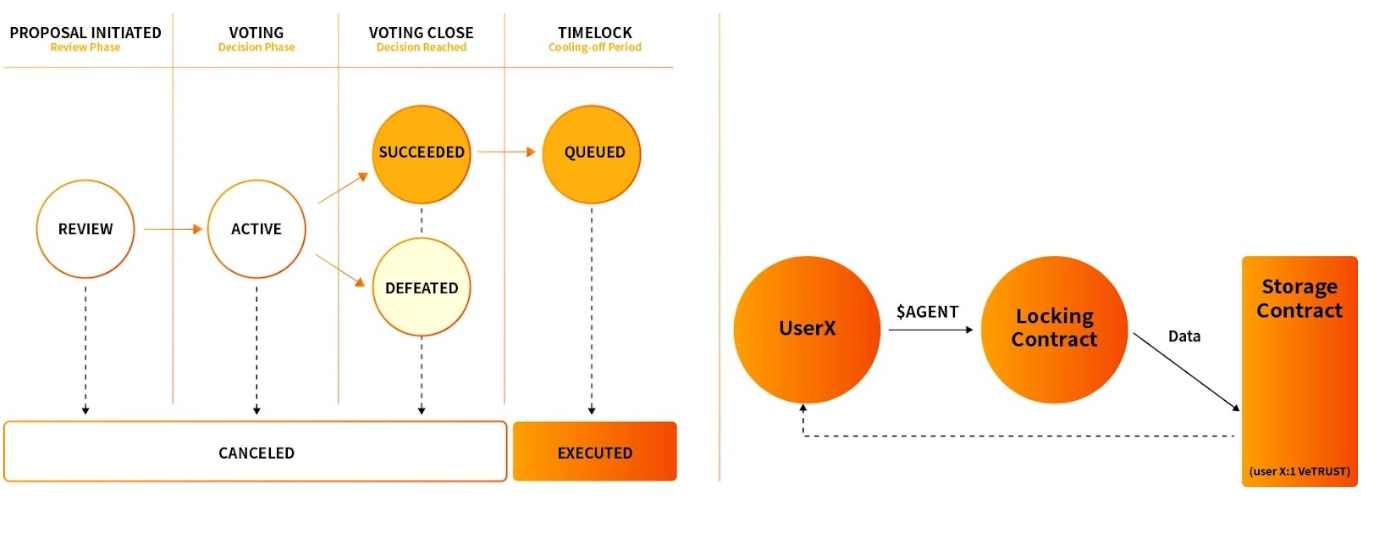

As illustrated by the graph above, any $AGENT token holder can stake a specific amount, like 2100 $AGENT, to become a Sequencer within the OP Stack. The OP Stack Sequencer comprises four distinct processes, each serving a unique purpose:

Op-node: Responsible for generating new L2 blocks and tracking L2 consensus on the L1 chain,working in conjunction with Op-geth. It plays a crucial role in tracking L2 consensus on the L1 chain.

Op-geth: Manages the L2 state and provides the necessary state machine API for the sequencer's operation.

Op-batcher: Responsible for posting new L2 blocks to the Data Availability (DA) layer.

Op-proposer: Tasked with posting state roots associated with L2 blocks to the settlement layer.

These processes collectively form the backbone of the OP Stack Sequencer, enabling efficient operation within the Optimism ecosystem.

Integrating EigenDA support into the OP Stack Sequencer involves two essential modifications:

DA Write Update: The Op-batcher service requires adjustments to alter how L2 transaction data is posted for Data Availability (DA).

DA Read Update: The Op-node service needs to be modified to change how L2 transaction data is retrieved from Data Availability (DA).

The modifications to the Op-batcher service involve dispersing the Optimism data frame to EigenDA and waiting for confirmation and the resulting BlobInfo object. If the EigenDA dispersal is successful, the Op-batcher writes the BlobInfo object to Ethereum calldata instead of the original data frame. In case of a failed EigenDA dispersal, the Op-batcher falls back to writing the original Optimism data frame to Ethereum calldata.

DA reads within the Op-node service are part of the L2 derivation pipeline, where L2 transaction batches are derived from Data Availability (DA). The logic in this service is adjusted to identify whether the calldata contains a BlobInfo object, indicating a successful EigenDA dispersal. If this object is present, the Op-node service retrieves data from EigenDA; otherwise, it follows its standard derivation path from the data frame. Future enhancements are anticipated to include handling more advanced EigenDA features like quorum selection for retrieval.

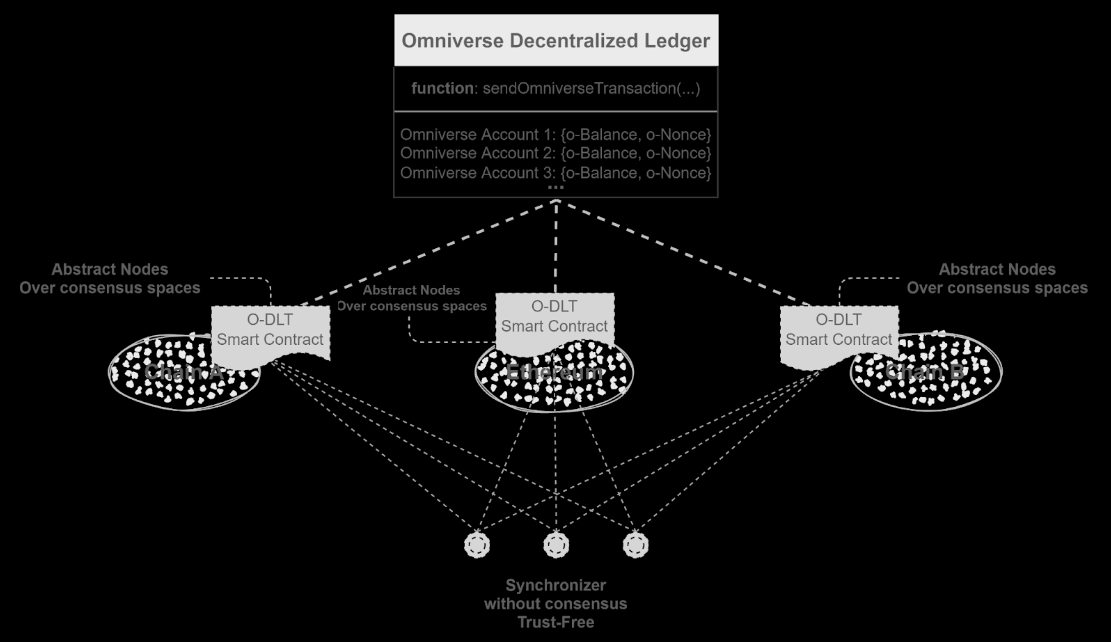

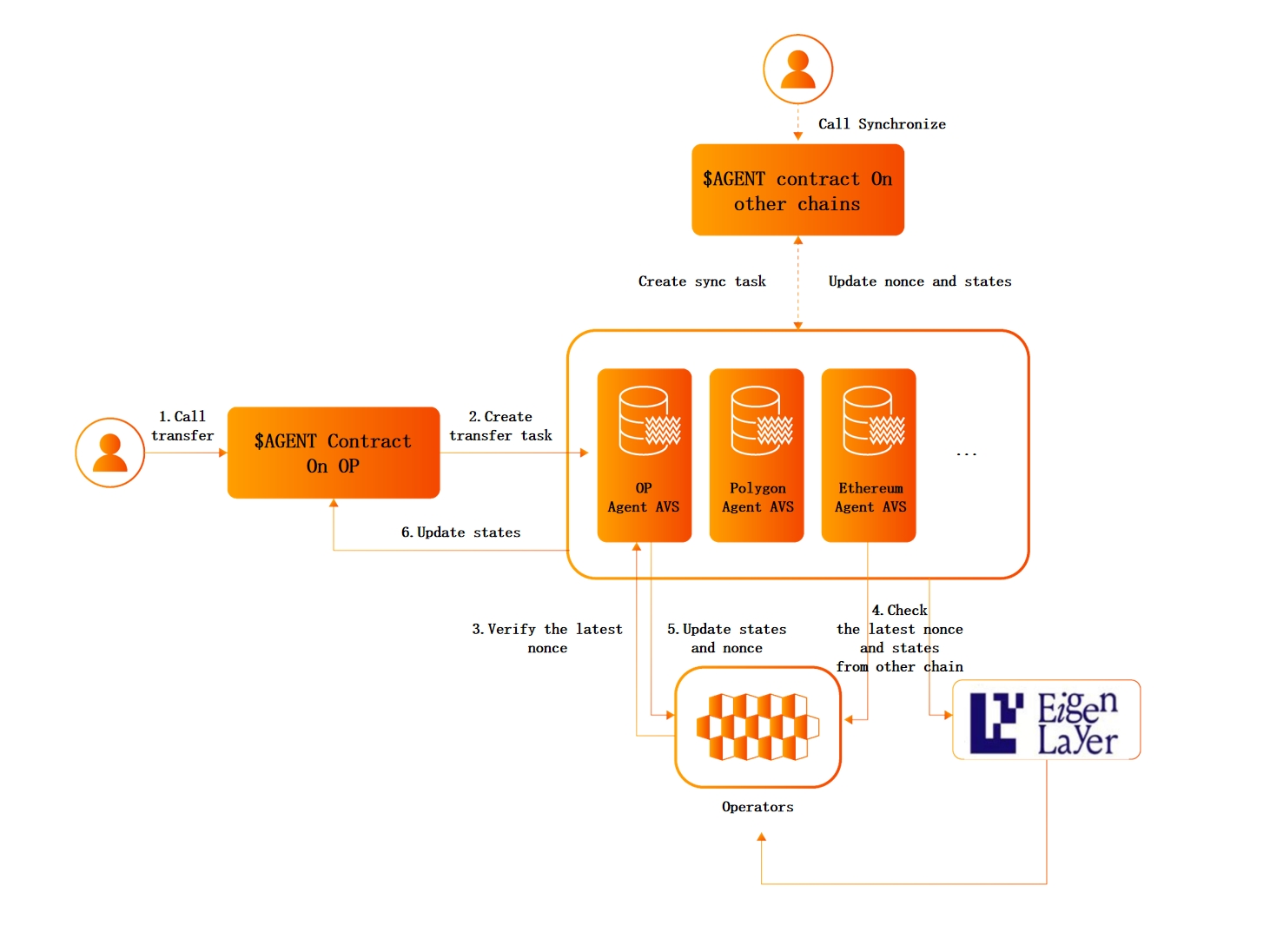

$AGENT Omnitoken for Future Omnichain Network

The $AGENT token, the mainnet token of AgentLayer, adheres to the ERC-6358 token standard and incorporates Eigenlayer AVS (Actively Verification Service). ERC-6358 enables synchronizing token states across multiple public chains, allowing $AGENT as omnichain tokens for omnichain network for other EVM-compatible L2s without the need for bridges.

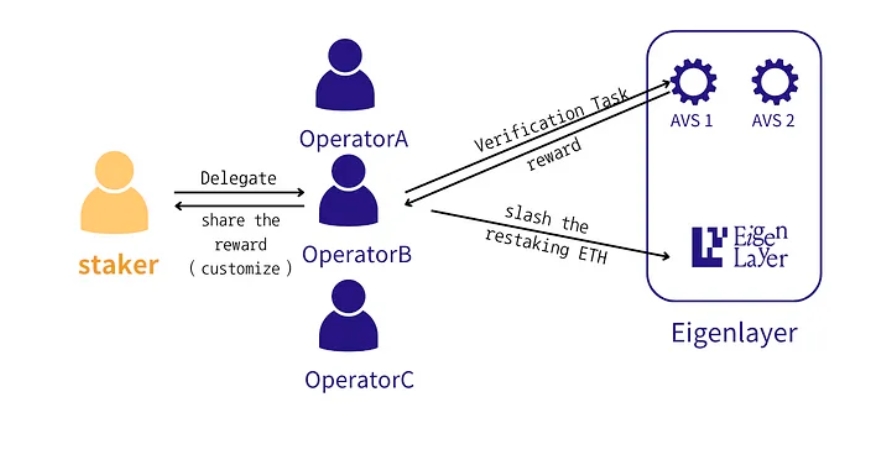

EigenLayer is a validation network that allows Ethereum stakers to reallocate their staked tokens to support various services. It enables users to repurpose their staked ETH to extend security to other decentralized applications (dApps) built on the Ethereum network. EigenLayer operates as a marketplace where developers incentivize validators to allocate their restaked ETH to secure different protocols, such as data availability layers, bridges, and oracle networks.

EigenLayer AVS applications necessitate their unique distributed validation semantics for verification. Our implementation leverages the EigenLayer AVS protocol to construct the Agent AVS system.

The process of transferring $AGENT tokens in the Eigenlayer AVS protocol involves triggering the AVS contract's log, operators retrieving the latest nonce and states from other chains, operators sending the signed result to the Aggregator, Aggregator receiving signatures above a threshold, and sending the validated result back to Agent AVS. Finally, Agent AVS calls the update function of the token contract to update the latest states and nonce.

To synchronize the balance of $AGENT for an address, an active synchronization function call is required. Subsequently, the final balance and nonce will be synchronized by the Agent AVS system.

EigenLayer's restaking mechanism plays a crucial role in enhancing the economic and security framework of various applications, including Agent AVSs. This symbiotic relationship aims to establish a high level of decentralization and security for LLM operations on the AgentNetwork from the outset. Moreover, it introduces a novel form of yield for EigenLayer operators engaged in $AGENT's ecosystem.

AgentLink

AI Agents in the Gen AI era may require a new protocol to facilitate multi-agent communication, collaboration, and coordination. The development of Agent Communication Languages (ACLs) based on protocols is also crucial for specifying the meaning of communicative acts in multi-agent systems. In this context, agents can be viewed as small, independent programs running in parallel, communicating through the network following certain rules. To manage communication efficiently, a protocol defines how information and messages are serialized and sent over the network, ensuring low-entropy messages for effective transmission under limited bandwidth constraints. Effective communication among AI agents in Multi-Agent Systems (MAS) involves explicit and implicit types of communication, essential for coordinating actions, learning, and achieving better outcomes.

The AgentNetwork layer encompasses the AgentLink functionality, which provides communication protocols for different Agents to facilitate seamless sharing of knowledge, information exchange, command transmission, and task result retrieval. This feature enables effective collaboration between Agents by establishing a structured framework for communication and interaction within the network.

AgentLink supports three distinct information delivery methods tailored for specific information transfer tasks: shared knowledge databases, shared message queues, and command queues. These methods facilitate the transmission of various data types to enhance efficient collaboration among multiple Agents, including text, vector databases, trained models, bytecode, and more.

Shared Knowledge Database

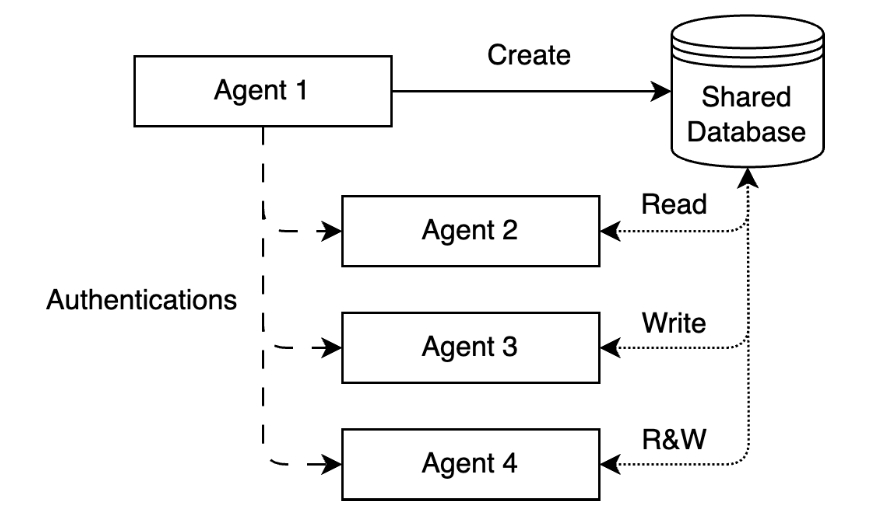

Each Agent has the capability to establish a shared knowledge database for storing information that requires sharing, with authorized Agents having access to this shared knowledge database. Different Agents can possess varying read and write permissions within the shared knowledge database, ensuring controlled access and collaboration among Agents.

Shared Message Queue

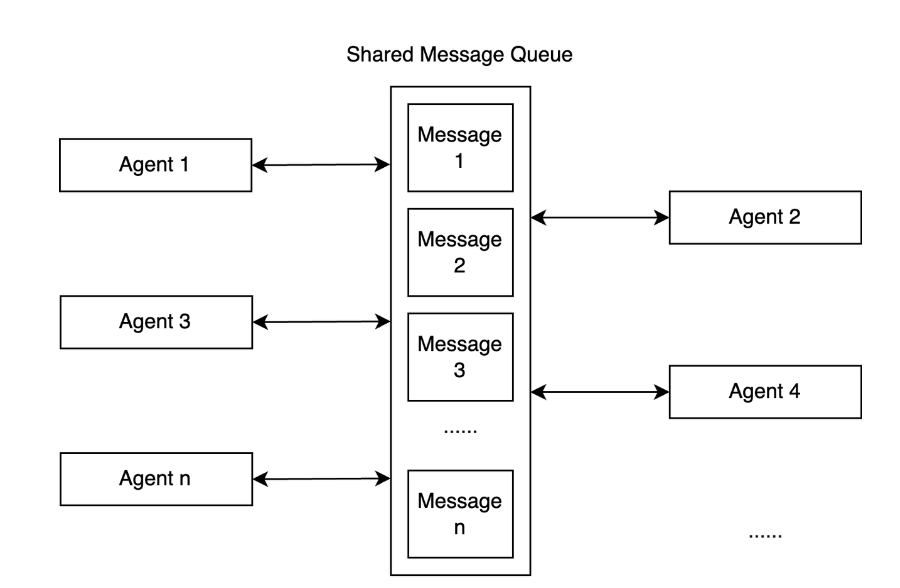

The shared message queue within the AgentLink functionality enables asynchronous data exchange between different Agents. Serving as a middleware, it establishes a reliable communication protocol that allows Agents to send and receive messages through a queue without immediate processing, facilitating efficient and seamless communication among Agents.

Command Queue

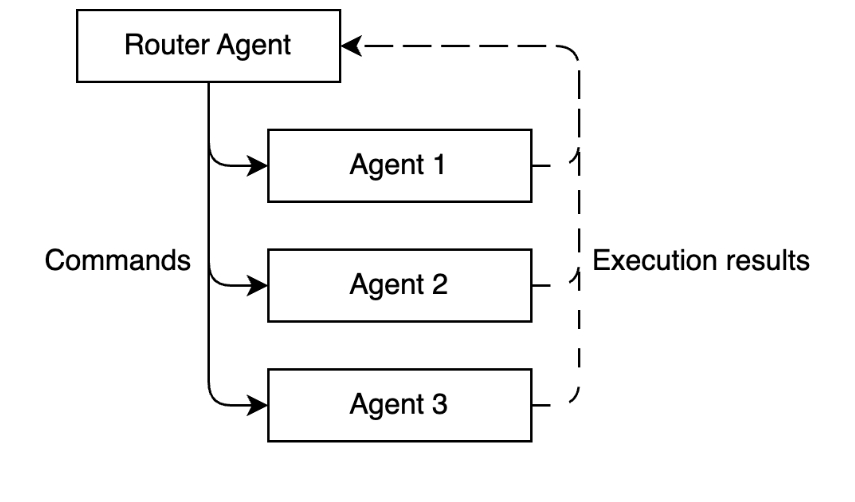

The command queue within the AgentLink functionality facilitates the asynchronous exchange of command information among different Agents. Operating akin to a message queue, it prioritizes the transmission and processing of dispatched commands. Certain lower-level Agents are mandated to unconditionally execute commands from the command queue issued by the managing Agent, ensuring prompt and efficient task execution.

AgentOS Layer

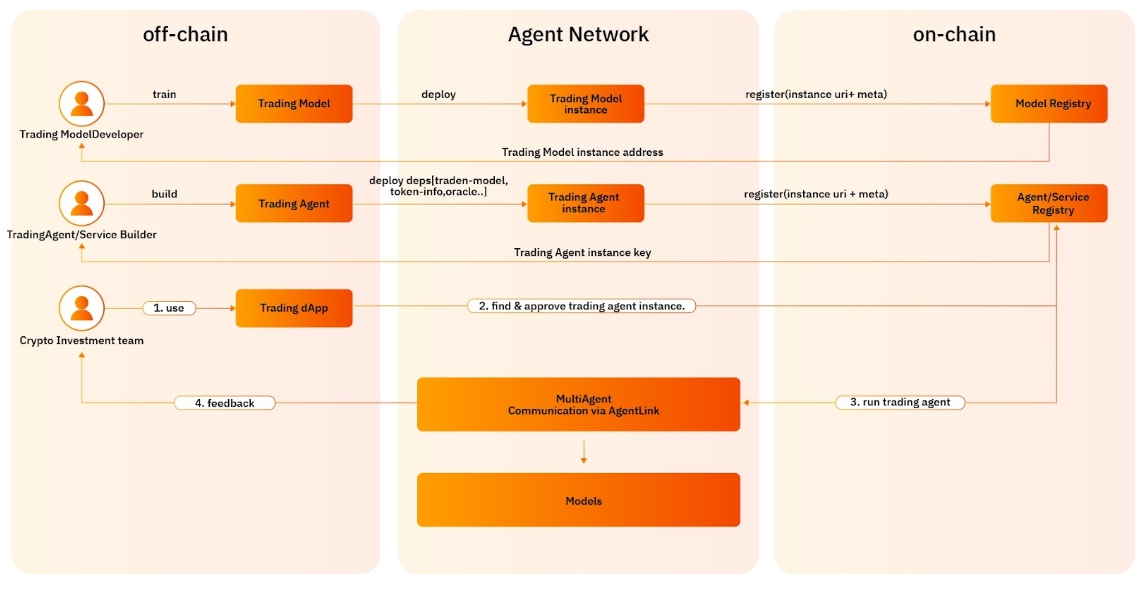

The AgentOS layer establishes integration between off-chain services and on-chain operations, enabling Agents within the AgentOS Layer to function in a distributed and decentralized manner. It achieves this by anchoring off-chain services, Agents, and Large Language Models (LLMs) to on-chain protocols, creating a contractual framework for the creation, operation, and protection of on-chain service ownership and rights confirmation.

The contract framework of the AgentOS Layer follows the core-periphery architecture, allowing peripheral functionalities to be modified without affecting the core data model. This design also enables extensibility through modular components, enhancing the flexibility and scalability of the system.

Decentralized AI Registry

Service and Service Registry

The primary interface for users to interact with Agents is through the Service, which is created by Developers deploying Agents based on business requirements. Once orchestrated and instantiated, these Agents form the constructed Service, which is then registered on the blockchain with the Developer’s wallet address as the default owner. During registration, various permission information is specified to maintain the Service on the blockchain effectively.

Agent and Agent Registry

Agents are primarily developed by developers or industry experts using the AgentOS SDK and stored on IPFS in the form of code and configuration files. It is essential to specify service information, Agent description, and the Agent's dependency ID during the creation of an Agent. Upon submission, an Agent is registered on the blockchain, where details such as the Agent URI information and meta information are provided to obtain the corresponding address of the Agent on the blockchain. By default, the developer's wallet address serves as the owner of the registered Agent on the blockchain.

Model and Model Registry

Models, including Large Language Models (LLMs), Gen AI models, and various others, are typically developed by model developers. These models are uploaded to IPFS along with their meta-information and then registered in the Model Registry on the blockchain. During registration, details such as the Model URI and meta information are specified to obtain the corresponding address of the Model on the blockchain. By default, the developer's wallet address serves as the owner of the registered Model on the blockchain.

Agents Services

The AgentLayer operates various official services within the network, including the Oracle for Multi-Party Verification of Information Accuracy, a Bot Monitoring Network for continuous Agent support, Data Availability Layer Services, and Data Privacy Services.

In the future, the services' capabilities will be extended to third parties to enhance the security and real-time functionalities of Agents.

Agents Router Protocol

To ensure the effective operation of Agents, it is essential to manage the interoperation between Agents, support autonomous interoperability among multiple Agents, and establish incentive rules. The envisioned collaborative interaction among Agents forms an interoperability network where each Agent can register with a protocol network called Router while in operation. Upon successful registration, all online Agents can communicate with each other through broadcast SDKs, transmitting their respective routing information.

Each Agent constructs its complete Agent routing table based on the received broadcast routing information, which is structured as follows:

Invest

01010111

Json

Security

00001010

pdf/jpg

When an Agent requires to manage collaborative tasks, it can directly access the relevant Agents by referencing them in the routing table according to their categories.

Upon referencing the routing table and effectively invoking the Agents, the Agent will receive a share of the overall Task's execution benefits.

Multiple Model Options

Developers have the choice to select from various models when creating Agents, including in-house developed base models and established commercial models available in the market. Opting for an in-house developed model for Agent invocation can lead to a reduction in specific transaction fees.

The project offers a proprietary base model that ranks among the top three State-of-the-Art (SOTA) open-source models in the Hugging Face community. In alignment with this and the Agent use cases, the project introduces TrustLLM, a large language model based on Mixture of Experts (MoE). TrustLLM offers enhanced performance, effectiveness, security, and multimodal generation capabilities.

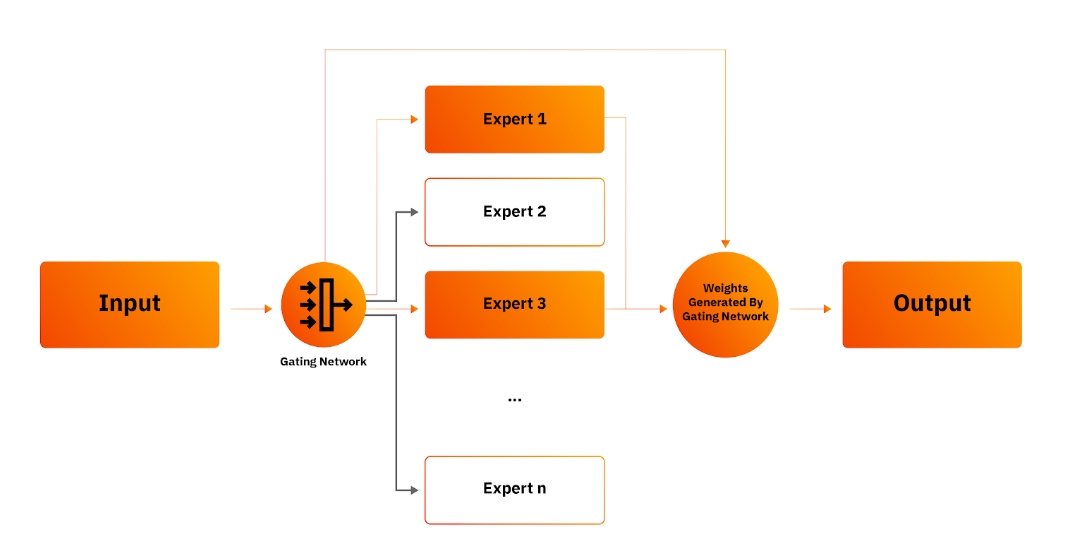

The Mixture of Experts (MoE) model is a powerful approach in machine learning that involves training experts on specific subtasks of a complex predictive modeling problem. This ensemble technique was initially developed within the field of artificial neural networks. In a MoE model, the complex task is divided into parts assigned to experts from different domains, each contributing their expertise. The results from these experts are then aggregated to form the final conclusion.

The MoE model consists of specialized sub-models known as "experts," with each expert focusing on a specific domain. The mechanism for determining which expert participates in answering specific questions is controlled by a "gate network”, often referred as GateNet. This GateNet plays a crucial role in interpreting predictions made by each expert and deciding which expert to trust for a given input.The Mixture of Experts (MoE) is a deep learning model that utilizes a sparse gating mechanism, involving a series of expert models and a gating model. The fundamental concept of the MoE model is to segment input data based on task requirements and assign them to specific expert models, allowing each expert to focus on distinct data segments, thereby improving the model's efficiency.

The architecture of Mixture of Experts (MoE) comprises two main components: GateNet and Experts. The GateNet's role is to determine which expert model should process a given input sample, while the Experts are a set of independent expert models, each responsible for processing a specific subset of inputs.

The GateNet in Mixture of Experts (MoE) functions as a sparse gating network that processes individual data elements and generates weights reflecting the importance of each expert model in handling the input data. These weights are typically computed using a softmax gating function to simulate a probability distribution over the experts or data units and select the top K most important experts.

As an illustration, consider a scenario with three expert models where the output probabilities are 0.55, 0.45, and 0.1. These values signify that the first expert contributes 55% to processing the data, the second expert contributes 45%, and the third expert contributes 10%. If the K value is set to 2, it implies that recommendations from the first two expert models are prioritized for precise answers, while suggestions from the third expert model can be utilized for more creative responses.

Experts: In the MoE model, expert models receive data assignments from the gating model during training. These expert models process the data segments they are assigned and generate outputs during the inference process. These outputs are then weighted and fused based on the efficiency and quality of each expert model in handling the corresponding features, resulting in the final prediction.

The Mixture of Experts model implements tailored training during the training phase through the gating mechanism and leverages the complementary advantages of different expert models during the inference phase. The expert models in MoE can be simple multilayer perceptrons (MLPs) or more complex large language models (LLMs).

The MoE model can activate only a subset of expert models based on the specific requirements of a task. This approach not only reduces the risk of overfitting but also enhances the model's generalization ability.

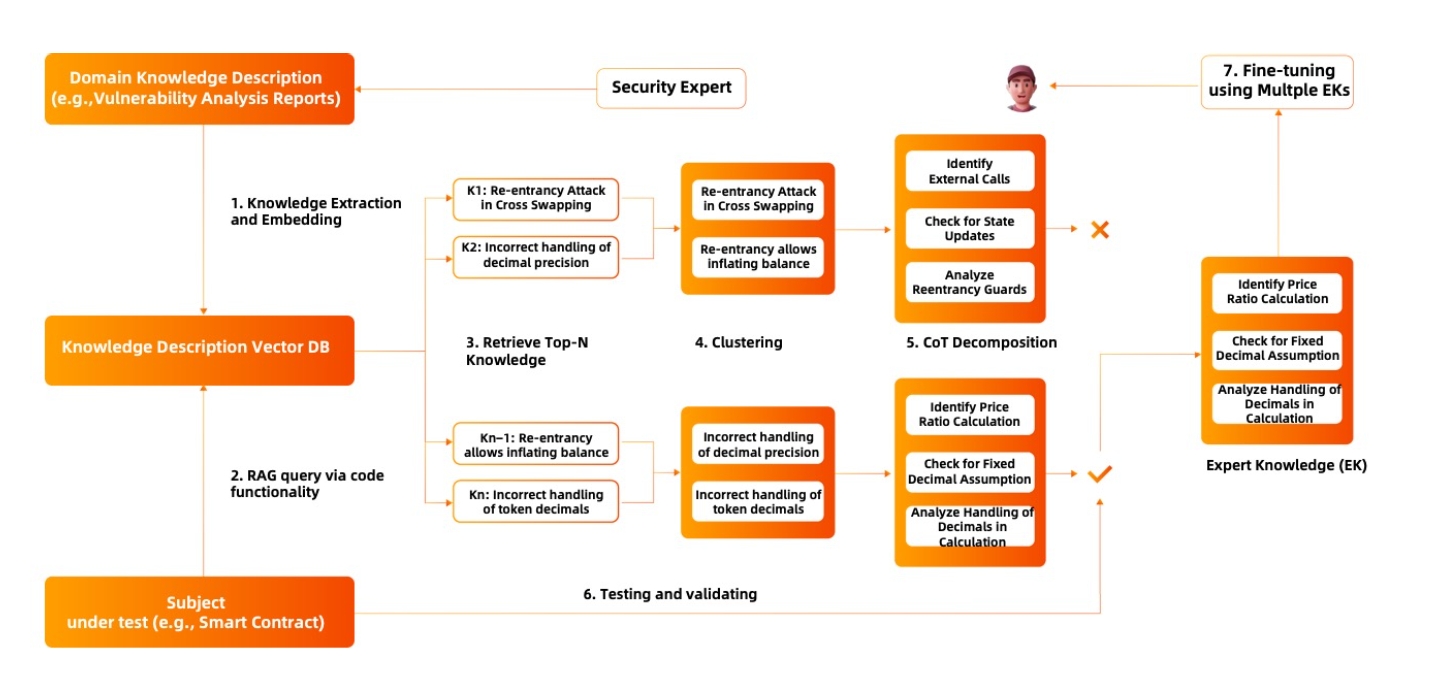

Chain of Thoughts

Developers are encouraged to adhere to the best development practices for AgentOS, as depicted in the "Chain of Thoughts" diagram. By utilizing the provided development toolkit and services, individuals can effectively convert personal knowledge into Agents.

Agents Collaboration Pool

To encourage collaboration among Agent developers, AgentLayer has introduced an Agents Cooperation Pool alongside the existing transaction marketplace. When Agents developed by different creators are repeatedly orchestrated together to deliver a registered Service, developers of these Agents will receive $AGENT token rewards from a predetermined pool within the Agents Cooperation Pool. The quantity of rewards is periodically claimed from the smart contract based on the number of invocations of the registered Service.

Utilizing this collaborative reward system, AgentLayer strives to establish the most extensive community of AI Agent developers globally. This community encourages developers to open-source their Agents and engage in collaborations to produce superior, sustainable, and regularly enhanced Agents.

AgentEx Layer

AgentEx currently comprises two types of Agents. The first type includes modular or scenario-specific Agents (Task-specific Agents)that specialize in handling particular transactions or tasks (Tasks). Users have the option to sell these Agents or offer subscriptions for them in the Agent Store. The second type consists of Character AI Agents, also known as human AI avatars, designed specifically for one billion knowledge workers, professionals and public figures. These AI Agents, in the form of humanoid applications, are directly accessible to end-users. Users can interact with these Agents by purchasing keys or accessing their services using tokens, stablecoins, or by issuing their own cryptocurrency.

Character AI Agent (CAA) Keys

Character AI Agents within AgentEx are orchestrated by developers or creators based on manageable modular Agents, reflecting the professional expertise of the developer's domain knowledge. These AI Agents can be directly deployed for public use or published in the official Agent Store. In the Agent Store, Character AI Agents offer two access modes: free access or subscription using $AGENT tokens and access after purchasing a Key.

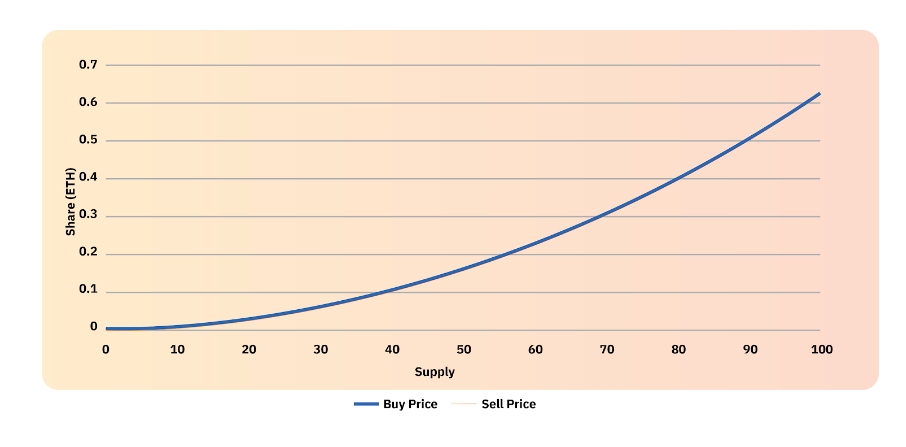

Character AI Keys serve as utility tokens with a dividend distribution mechanism. Upon acquiring a Key, users gain access to the AI Agent, engage in related activities, receive $AGENT airdrops, and benefit from dividend distributions originating from the AI's paid subscriptions. The pricing of a Key is determined by the following price curve formula: price = S^2/16000 (TBD), where S represents the total number of keys currently minted.The formula indicates that:

The price curve is uniform for all users, ensuring that the same quantity of Keys corresponds to an identical price.

The absolute value of the price growth follows a linear pattern.

The price difference between consecutive Key purchases exhibits linear growth, calculated as (2S+1)/16000.

Initially, the growth rate is exponential; however, as the number of Keys increases, particularly into the hundreds, the growth rate becomes more gradual.

Task-specific AI Agents (TAA)

Task-specific Agents within AgentEx are built by developers based on specific issues, such as static vulnerability detection in Solidity, and then encapsulated into containers for orchestration by Agents. Each Agent is uniquely identified and associated with an Agent NFT under a subscription model, enabling listing for subscription or direct transfer on the Agent Store. Developers are advised to opt for verified containers, like confirmation Agents for static vulnerability detection in Solidity, to enhance the efficiency and effectiveness of their Agent development.

Agent Store

The Agent Store functions as a holistic platform for discovering and transacting various types of Agents, encompassing TAAs and CAAs. Additionally, the Agent Store features a routing Agent (MetaAgent) to assist users in comprehending their needs and selecting AI Agents from diverse categories for trial, purchase, and utilization.

The user base of the Agent Store extends beyond humans to include robot users. By offering comprehensive APIs and diverse transaction modes, Agents can autonomously select other intelligent Agents they require from the Agent Store based on task objectives, instructions, and their own needs. This capability enables swift transactions and the formation of multi-Agent teams for collaborative task completion.

The transaction modes in the Agent Store primarily include Purchase Mode, Auction Mode, and Automated Market Maker (AMM) Mode.

Purchase Mode: Users have the option to purchase particular Agent services tailored to their requirements, enabling customization of choices concerning permissions, pricing, and service conditions.

Auction Mode: Buyers can acquire the right to use certain Agents through bidding, reflecting market demand realistically and promoting fair price competition.

Automated Market Maker (AMM) Mode: Transactions are completed through algorithms rather than traditional order books, ensuring instantaneity and liquidity of transactions, commonly used in cryptocurrency and decentralized finance fields.

These modes offer different ways for users to interact with Agents in the platform, catering to various preferences and needs.

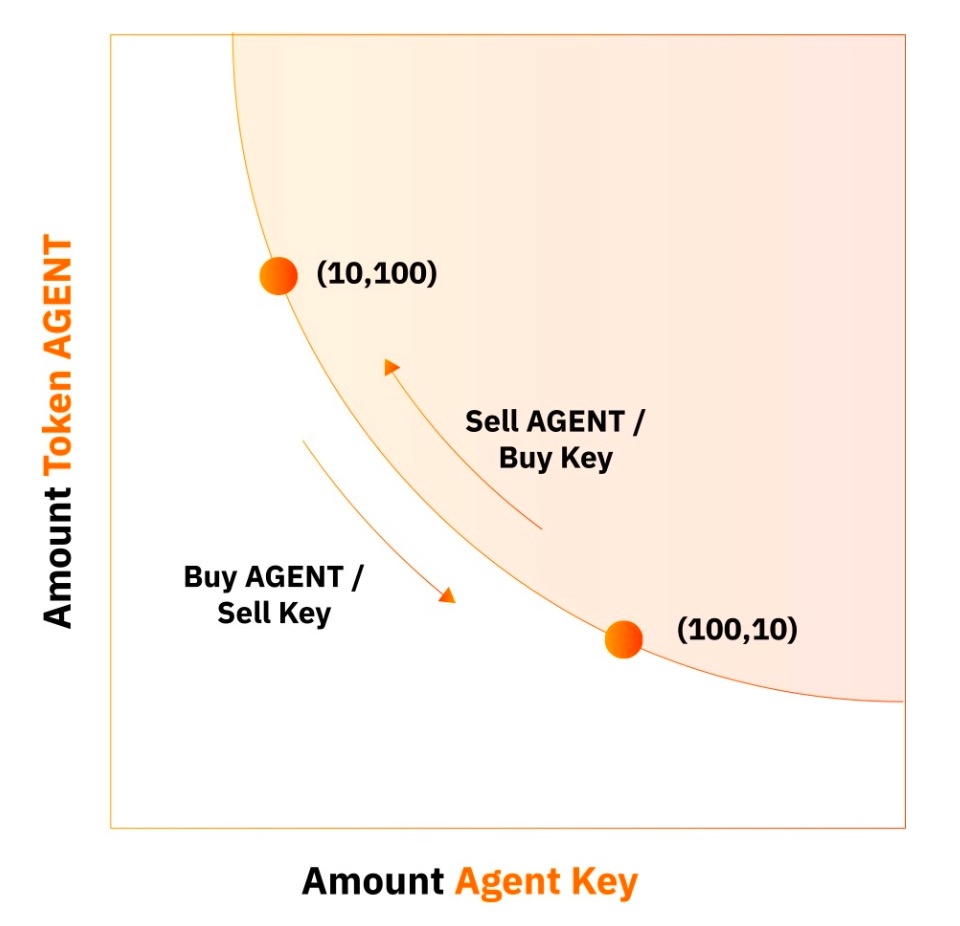

The transaction mode in the Agent Store based on Automated Market Maker (AMM) operates as follows: Agent developers segment the usage rights of an Agent into basic usage units, represented by keys stored in specific asset pools. Each asset pool contains $AGENT tokens pre-deposited by users, facilitating transactions through algorithms for instantaneous and liquid exchanges. The AMM algorithm employs the following conservation function to facilitate efficient and automated transactions within the Agent Store:

When a user pays a certain amount of $AGENT tokens, the calculation formula for the number of Agent keys that can be purchased is as follows:

Similarly, when a user needs to purchase a certain number of Agent keys, the calculation formula for the amount of $AGENT tokens to be paid is as follows:

The process of distributing transaction fees collected during trading involves agent developers, investors and users depositing idle Agent keys or $AGENT tokens into asset pools to earn fee rewards, enhancing liquidity and ecosystem development. We will provide detailed explanations in the tokenomics model. The AMM transaction mode described above ensures that:

The selling price of a key for a specific Agent increases with rising demand and decreases when demand falls.

All pricing can be dynamically and instantly completed, greatly increasing the speed and convenience of transactions.

The mechanism allows for instant and efficient transactions, promoting users, developers and investors to deposit idle $AGENT tokens and Agent keys into asset pools to enhance liquidity and earn profits.

Programmable Trust by Design

The security of the AgentLayer relies on three key aspects of security enhancement.

Firstly, leveraging the programmable trust out of Ethereum via EigenLayer.

EigenLayer offers three key trust models that can be accessed programmatically from Ethereum: economic trust, decentralized trust, and Ethereum inclusion trust. These models can be combined to meet the specific trust requirements of an Autonomous Verification System (AVS). EigenLayer provides a platform where developers can mix and match these trust elements to create tailored trust models for their AVS.

By tapping into a network with a substantial value of $45 billion and 850,000 validators on Ethereum, AgentLayer enables developers to leverage the security and trust features programmatically to meet their system requirements, without the need to establish a trust network from scratch.

Secondly, aligning incentives for contributors to represent off-chain hosted code on chain to mitigate a variety of attacks. The on-chain protocol does not interact with off-chain code, meaning that the IPFS hashes referenced in NFTs are not visible to the protocol. Additionally, the protocol cannot verify if the dependency structures in models, agents, and services NFTs accurately reflect the off-chain code's actual dependency structure. To address this, the tokenomic design considers direct and governance-mediated indirect contributions to create an incentive-compatible system for representing off-chain hosted code on-chain. This design aims to mitigate various attacks by ensuring transparency and aligning incentives for contributors.

Thirdly, we, as a team of security experts, will deploy a number of security-oriented agents to do security scanning and monitoring for models, agents and services for potential vulnerability detection and risk mitigation. All the above measures provide a secure foundation for agent interactions, ensuring trust, reliability and data integrity in multi-agent systems.

Our team of engineers possesses extensive theoretical and practical experience in enhancing code security, model security and data security for Gen AI. This expertise includes implementing measures against prompt jailbreaking, preventing data contamination during data preparation and managing adversarial attacks during model operation.

To enhance the security of the AgentNetwork network protocols, our team utilizes in-house formal verification tools and static code scanning tools to proactively identify vulnerabilities in the protocol code before deploying it on the mainnet. These tools play a crucial role in ensuring the robustness and integrity of the network, safeguarding against potential security threats and breaches. By employing these advanced security measures, we aim to maintain a secure and reliable environment for executing Agents and processing user requests within the system.

The AgentNetwork network security measures encompass several key elements:

Node Operation: Operators manage nodes, each running at least one instance of an Agent, with a total of n Agent instances.

Secure Communication: Each pair of Agent instances within a node can communicate securely and independently.

Agent Code Execution: The majority of n Agent instances run the defined Agent code, with a limit ensuring proper service functionality even if up to 1/3 of instances are malicious.

Malicious Behavior Handling: Malicious Agent instances can deviate from their designated code arbitrarily.

Blockchain Registration: Nodes register on the L1/L2 blockchain to ensure economic security for the service.

Deposit Requirement: Each operator must lock a deposit for every owned Agent instance on the blockchain where the node is registered.

Misconduct Punishment: Agents can penalize each other's misconduct by submitting fraud proofs at the node level, leading to a reduction in the deposit of the malicious instance on the target chain.

Deposit Release: The deposit locked by the node owner equals the total deposit requested by the Agent instances, incentivizing deposit release when the service lifecycle ends.

These security measures collectively contribute to maintaining the integrity and reliability of the AgentNetwork network protocol, ensuring secure and efficient operations within the system.

By default, the assumption is that the node owner acts honestly within the AgentNetwork protocol. When the node service is initiated, the node's multisignature wallet falls under the contract's control. If the node owner opts to terminate the service, control over the multisignature wallet of the node reverts to the node owner. To reduce control over assets in the node's multisignature wallet, additional smart contract constraints can be introduced by the node owner. For instance, assets can be placed in custody or the service owner can be transformed into a limited-functionality proxy contract, restricted to interacting solely with the node service and unable to directly engage with the service's multisignature wallet. This approach ensures secure management and control over assets within the network, enhancing transparency and accountability in transactions and operations.

Due to the potential presence of malicious actors in every layer of a decentralized application, shared security and trust are crucial. Building robust and secure off-chain proxy services is essential to enhance security measures.

The node service can inherently rely on various sources of trust. However, the node service can leverage additional sources of trust, defined as high-cost adversarial compatible modules. These fraud-proof mechanisms can detect and punish misconduct and reward honest reporting of misconduct, where the benefits of adversarial behavior are less than those of honest behavior.

The adversarial compatible module is an extension component that augments the predefined objectives of proxies within the node. This module allows nodes to detect malicious or incorrect activities by other actors in the network. Consequently, nodes within the network also take on the role of monitoring and reporting any violations committed by other nodes, contributing to tracking the reputation of nodes and their operators. In cases where a majority of nodes agree on malicious behavior, penalties can be imposed by reducing the capital locked by the operators of the offending node. Furthermore, honest reporting is incentivized through rewards for truthful alerts. Ultimately, this module ensures that adhering to protocol rules is more beneficial than violating them.

Each node's service can internally detect misconduct by penalizing actions, which hinders nodes from engaging in malicious behavior. Additionally, the system incentivizes honest reporting by rewarding agents for making truthful alerts, discouraging false reporting of misconduct.

Development Plans and Roadmap

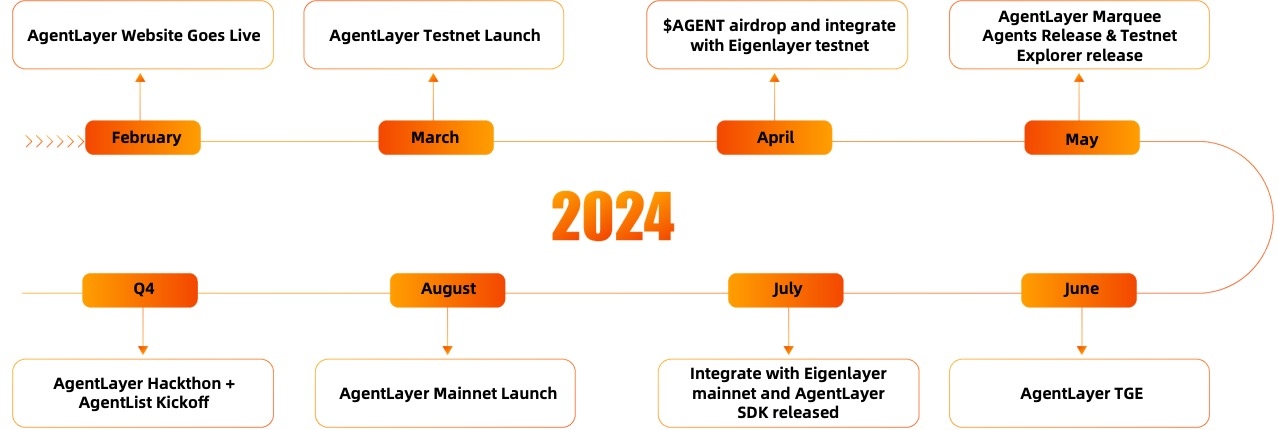

February - AgentLayer Website Goes Live

March - AgentLayer Testnet Launch

April

$AGENT airdrop

Integrate with Eigenlayer testnet

May

AgentLayer Marquee Agents Release

Testnet Explorer release

June - AgentLayer TGE

July

Integrate with Eigenlayer mainnet

AgentLayer SDK released

August - AgentLayer Mainnet Launch

Q4

AgentLayer Hackthon

AgentList Kickoff

The above represents AgentLayer's short-term development plan, aimed at progressively building a feature-rich, secure, and reliable blockchain network and ecosystem through these stages. From the establishment of a foundational large-scale model to the eventual launch of security tools, each step is designed to provide users with a higher quality and more convenient service experience.

In the mid-term, AgentLayer will also build the industry's first AI Agent Chain within Cosmos, becoming one of the most essential infrastructures for AI asset issuance in the Web3 industry. Additionally, in expanding the categories of Agents, the project aims to better integrate with public figures and public goods, enabling humanity to better understand AGI and finding harmonious coexistence models with AGI. Moreover, it will provide a potential fundraising channel for public goods.

III. $Agent - New AI Currency for Agent Economy

Tokenomics Objectives

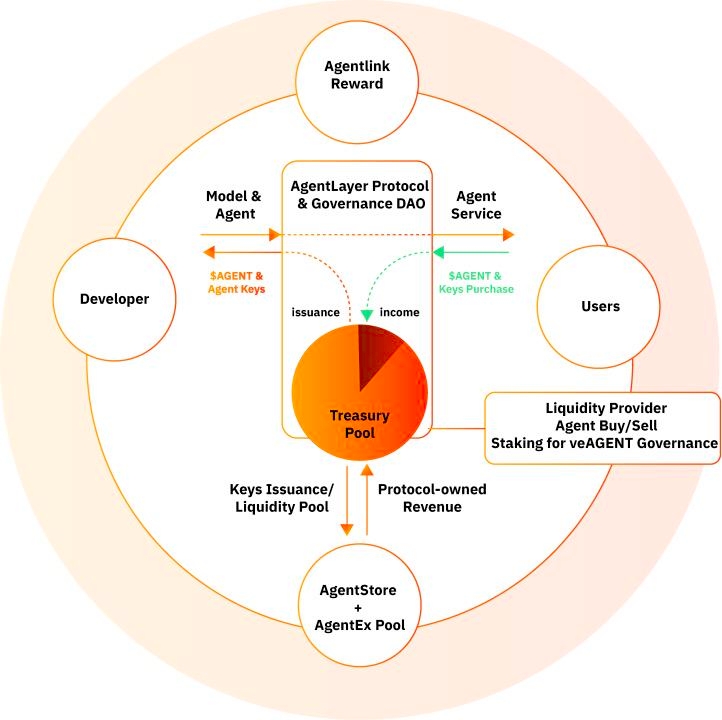

$AGENT, the native token of the AgentLayer, plays a crucial role in facilitating transactions, governance, and ecosystem development within the AgentLayer ecosystem. $AGENT is used for accessing various decentralized AI Services or Agents on Agent Store, paying transaction fees, earning yields through staking, participating in Agent Key or Token sales, and as a governance token allowing holders to vote on network-related decisions. Aside from the above mentioned functions and utilities of $AGENT, AgentLayer‘s tokenomics has been designed with several objectives in mind:

Firstly, the AgentLayer‘s tokenomics are designed to address the issue of insufficient remuneration for Gen AI model and agent developers' contributions in open-source development. Users can use $AGENT token to buy and access the services offered by Agents directly from Agent Store under AgentEx Layer so as to bring revenue to Agent developers. AgentLayer also utilizes a unique staking model to allow developers to track their code contributions on-chain and receive rewards for their contributions' usefulness.

Secondly, the AgentLayer tokenomics aim to promote software composability within the ecosystem, allowing existing model and agent APIs to be used as building blocks for higher-order services or applications. This composability facilitates exponential returns by enabling NFTs representing models and agents to be combined into advanced services and applications across the protocol, DApp, and DeFi ecosystems.

Thirdly, AgentLayer's tokenomics serves to establish a flywheel mechanism that engages developers and creators globally, attracts increasing value, and generates revenue by offering decentralized protocol-owned autonomous AI services managed and collectively owned by The Agent Governace DAO(TAG DAO).

Lastly, AgentLayers‘ tokenomics facilitate the growth of a decentralized AI agent economy by serving as the native token for the AgentLayer's Agent Chain deployed on L2.

AgentLayer’s Protocol Revenue Model

Protocol/Network-owned Services

The protocol can leverage governance to operate services, usually in the form of public goods, such as security, risk management, oracles, etc., with profits being donated back to the protocol. A portion of these donations, excluding those allocated to component/agent developers, is kept in the treasury for future use.

AgentLayer, as a L2 public blockchain for AI Agents, generates its revenue from its centralized sequencer, which earns revenue by selling block space and processing transactions efficiently at the execution layer of the tech stack. The spread between what users pay and what AgentLayer charges for block space on Ethereum constitutes their profit.

Agents’ Sale Revenue Split

Agent sale - Agent developers or providers can sell Agents on the marketplace using $AGENT as payment. This can involve one-time fees or usage-based fees. AgentLayer will charge a small portion out of Agent service sale.

Transaction Fees from AgentEx

The AgentLayer ecosystem incorporates features to enhance the functionality and appeal of Agents, fostering robust economic interactions between Agents and users. A dedicated DEX platform within AgentLayer, called AgentEx, allows Agents to mint, manage and trade keys, a special form of tokens, provided they meet specific criteria. Agents in the AgentLayer ecosystem can mint tokens by meeting certain requirements like staking a number of $AGENT tokens, passing verification, and presenting token details for review. A review committee approves token issuance to ensure it aligns with ecosystem goals. AgentLayer provides tools for token management, emphasizing security and compliance. As such, the AgentLayer protocol and receive a percentage of fees out of every key transactions. The protocol may generate revenue out of Agent Key Swap in the AgentEx, powered by the AMM trading model.

In the AMM trading model, users can become liquidity providers by depositing Agent keys or $AGENT tokens or other whitelist tokens such as $ETH into the corresponding asset pool, earning LPTokens. The distribution of transaction fee rewards is based on the amount of LPTokens held. This system involves users paying trading fees for exchanging tokens with the AMM, which act as returns for liquidity providers.

The distribution mechanism of LPTokens is as follows: when a user deposits both Agent keys and $AGENT tokens into the pool without altering their proportion in the asset pool, the LPTokens received by the user can be calculated using a specific formula as follows:

When a user deposits only one type of asset, such as depositing only $AGENT tokens, the LPTokens obtained by the user can be calculated using the following formula:

When the platform receives transaction fees, they are directly deposited into the asset pool, increasing the assets available for withdrawal by liquidity providers holding LPTokens. This process enables liquidity providers to earn a profit from their participation in the pool.

When a user wants to redeem a specific amount of LPTokens, the assets they receive can be calculated as follows:

When a user chooses to receive Agent keys and $AGENT tokens simultaneously according to the proportion in the asset pool:

When a user chooses to receive only one type of asset (such as $AGENT tokens), the user first receives both Agent keys and $AGENT tokens simultaneously according to the formula mentioned above, and then convert them into one type of asset in the Agent Store.

Additional Revenue Models

The utilization of $AGENT tokens within the AgentLayer ecosystem extends beyond core functionalities, encompassing various additional use cases:

Advertising and Promotion: The Agent Store platform can provide advertising and promotional space to third parties, charging $AGENT tokens as fees. Different models like pay-per-click, pay-per-impression, or pay-per-conversion can be implemented for these transactions.

Partnerships: Collaborations with other projects or companies lead to partnerships aimed at ecosystem promotion. These collaborations may generate $AGENT tokens or other revenue forms, for instance, other ecosystem token airdrops.

The versatility of $AGENT tokens within the AgentLayer ecosystem is exemplified by a range of use cases that facilitate diverse interactions, services, and collaborations.

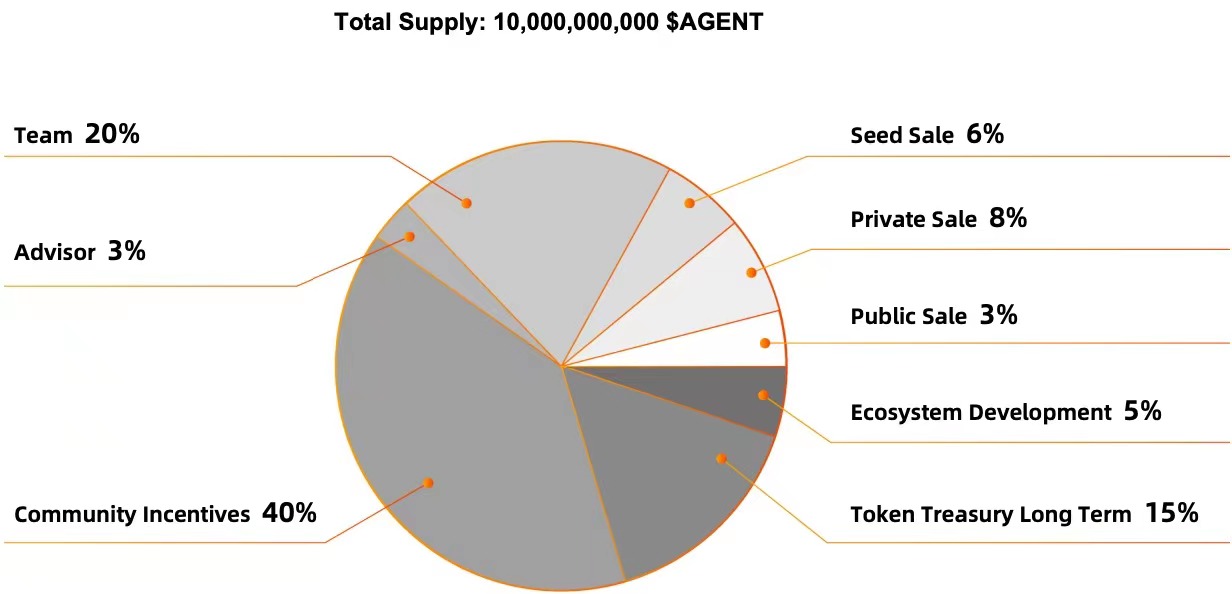

Token Supply and Distribution

The token is intended to function as an incentive, governance, and utility token with a total supply of ten billion tokens. AgentLayer has developed a thoughtful token allocation strategy to establish a lasting alignment between token holders and the project's prosperity. This plan is designed to incentivize community engagement, support the operating team's efforts, and reward early investors and partners. The breakdown of the token allocation plan is as follows:

Community Incentives

Allocation Ratio: 40%

Description: To express gratitude for the community's support and enthusiasm, 40% of the $AGENT tokens will be allocated as community giveaways. These tokens will be distributed to users through diverse activities and mining initiatives, fostering community engagement and participation.

Ecosystem Development

Allocation Ratio: 5%

Description: This allocation of tokens, amounting to 5% of the $AGENT tokens, is dedicated to advancing the ecosystem's development and growth. Managed by the project team, these tokens will be utilized to finance partners, developers, and other pertinent projects, contributing to the ecosystem's expansion and enhancement.

Core Contributors

Allocation Ratio: 20%

Description: A 20% allocation of the $AGENT tokens will be reserved for the team, including equity investors, as an incentive and acknowledgment of their contributions to the project's development and advancement. This allocation aims to ensure the team's ongoing dedication to the project's success and development.

Token Treasury (Long Term Development)

Allocation Ratio: 15%

Description: This allocation, constituting 15% of the $AGENT tokens, is designated to support the long-term development and operation of the ecosystem. Specifically, these tokens will fund partners, developers, and other relevant projects, incentivizing and rewarding contributors to the ecosystem, to ensure the project's long-term stability and sustainability.

Advisors

Allocation Ratio: 3%

Description: Advisors will receive 3% of the $AGENT tokens as a token of appreciation for offering strategic guidance and professional advice, contributing to the project's advancement and success.

Token Sale

Allocation Ratio: 17%

Description: A total of 17% of the $AGENT tokens will be allocated through seed sale, private sale, and public sale, divided as follows:

Seed Sale: 6%

Private Sale: 8%

Public Sale: 3%

Through the above allocation plan, AgentLayer seeks to create a balanced, sustainable, and mutually advantageous token economic alignment. This strategy is designed to propel the long-term growth and success of the entire AI Agents creation platform, fostering prosperity and development across the ecosystem.

IV. Governance

Governance is a fundamental aspect of the AgentLayer project, focusing on community engagement, technological advancement, and ecosystem growth. The AgentLayer Governance DAO (TAGDAO) , comprised of veAGENT token holders, serves as the key decision-making body. These token holders actively participate in governance decisions through voting on matters like feature development, fund allocation, and community rule-making.

Below is an overview of AgentLayer governance framework:

Importance of Governance

Governance plays a crucial role in ensuring transparency, fairness, and adaptability in decision-making processes within organizations. It establishes clear lines of responsibility, promotes accountability, and helps prevent misconduct and unethical behavior.

In the context of autonomous agents on the web, governance frameworks are essential for defining how agents should act in different situations, ensuring alignment with stakeholder requirements and norms. These frameworks help in managing conflicts between agents' autonomous goals and stakeholder interests by providing guidelines for decision-making processes. By considering norms, policies, and preferences as key abstractions in multiagent systems, governance frameworks aim to facilitate collaborative interactions among agents with diverse origins and functions.

Overall, the importance of governance lies in establishing structures that promote accountability, transparency, ethical behavior, risk management, conflict resolution, and long-term sustainability for the AgentLayer’s ecosystem.

Roles and Processes of Governance

Decision Involvement: Governance structure enables community members to submit governance proposals and participate in the decision-making process. Proposals may encompass a range of changes, including alterations to system parameters, shifts in technological directions, or the introduction of new features. This flexibility allows for continuous improvement and adaptation to meet evolving needs and opportunities within the ecosystem.

Discussion and Voting: Following proposal submission, community members participate in discussions and voting processes. The voting weight assigned to each member is determined by the quantity of veAGENT tokens held and the duration of their locking period. This system ensures equitable decision-making based on token holders' commitment and engagement within the ecosystem.

Proposal Execution: Upon approval of a governance proposal, it undergoes execution. To maintain prudence, a time delay is implemented before the proposal is executed.

Emergency Handling: In exceptional cases like addressing security vulnerabilities, the community has the option to expedite changes to the on-chain protocol by utilizing a multisig wallet, bypassing the standard governance process for swift action.

Governance Structure

DAO Organization: AgentLayer embraces a decentralized autonomous organization (DAO) framework, enabling significant contributors and supporters to engage in the decision-making process, fostering a more inclusive and participatory governance model within the ecosystem.

veAGENT Token: The veAGENT token is the governance token of AgentLayer, acquired by locking the native token $AGENT. The quantity of veAGENT held and the duration of locking determine the level of participation in governance decisions within the ecosystem. This mechanism allows contributors to have a proportional influence based on their holdings and commitment to the governance structure.

Multisig Wallet: For swift responses during emergencies, the community maintains a multisig wallet with the capability to implement on-chain protocol adjustments promptly as needed, ensuring efficient handling of critical situations within the ecosystem.

Community Building

AgentLayer prioritizes community engagement and development, fostering an environment where significant contributors and supporters actively participate in shaping decisions and collectively advancing the technology. By incorporating incentivization strategies, such as allocating a portion of profits to the protocol to reward the movers and shakers of the community, the project attracts global developers to contribute to the ecosystem, stimulating growth and innovation within the community.

Community Watchdog Agents

The AgentLayer brings in a special class of Community Watchdog Agents to ensure the community's transparency, safety and security. Additionally, the AgentLayer Goverance DAO (TAG DAO) has been established, allowing community members holding veAGENT governance tokens to participate in decision-making processes to foster transparent and decentralized collaboration and decision making.

Roles and Functions of Community Watchdog Agents:

Monitoring Community and Social Media Feedback: Community Watchdog Agents actively oversee discussions and feedback on community platforms and social media in real-time, ensuring transparent and timely information collection and dissemination. They gather community input, suggestions, and concerns, providing valuable data to support governance decisions.

Monitoring Model Data Leaks: Community Watchdog Agents implement stringent monitoring mechanisms to prevent any unauthorized data leaks, safeguarding the security of model data. In case of potential security threats, they promptly raise alerts and notify the relevant teams for immediate action.

Implementation of Testing Agents: Testing Agents play a crucial role in ensuring the stability and functionality of the system by conducting thorough testing of newly introduced features and updates. They simulate diverse usage scenarios to identify and rectify potential issues before the actual deployment phase.

In summary, AgentLayer's governance mechanisms prioritize transparency, fairness, and continuous innovation, fostering a platform where community members actively engage and collaborate in the project's development.

V. AgentLayer’s Ecosystem

In the realm of Gen AI, an agent represents a system capable of independently comprehending, planning, and executing tasks. The rise of large language models (LLMs) has underscored the significance of constructing and utilizing agent systems.

With the continuous progress of LLM technology and the improvement of the ecosystem, we can expect agents to play an important role in more areas. For example, in fields with high requirements for professional knowledge, such as law, medicine, and finance, agents can assist experts in completing complex tasks, improving work efficiency and quality. At the same time, with the continuous accumulation of user data and the optimization of the feedback mechanism, the intelligence and user experience of agents will also be continuously improved.

However, it is also important to be aware of the potential risks and challenges of agent technology in the development process. For example, privacy protection, security, and collaboration with human work are all important issues that need to be focused on and resolved.

Therefore, while promoting the development of agent technology, it is also necessary to strengthen the formulation and implementation of relevant laws and regulations to ensure the healthy and sustainable development of the technology.

Ecosystem Bootstrapping

This convergence of AI Agent and Crypto combines the decentralized nature of Crypto with the analytical capabilities of AI, offering various benefits across different sectors. The combination of AI Agent and Web3 can revolutionize industries like finance, healthcare, education, and entertainment by providing intelligent services and enhancing security and efficiency.

During the bootstrapping phase of AgentLayer, the protocol-owned services can be utilized by the AgentLayer Governance DAO to operate services, such as mission-critical public goods, including but limited to AI-powered security checking, auditing, code generating Agents. This approach can be extended to DAO participants who propose agent components. After a successful governance vote, popular categories of AI Agents will be open for developers to implement, allowing them to capture future rewards associated with community selected categories.

We think there are tremendous use cases for autonomous decentralized services empowered by AI Agents. For instance, most decentralized organizations today face risks due to non-autonomous processes, while smart contract protocols often rely on suboptimal systems. AgentLayer provides scalable solutions in these areas with autonomous services that are decentralized, ownable, and scalable. Just name a few examples.

AgentList - AgentLayer’s Ecosystem Launchpad

AgentList is a pioneering platform designed to function as a launchpad for Decentralized AI Agent Tokens, akin to established platforms like AngelList and BNB Launchpool. This innovative platform is dedicated to fostering the growth of decentralized AI projects within the AI+Crypto space, which plays a crucial role in the AgentLayer protocol's ecosystem. By providing a conducive environment for the creation, funding, and advancement of AI initiatives, AgentList aims to be a catalyst for innovation and development in the decentralized AI sector.

AgentLayer's token holders have the opportunity to stake their crypto assets, such as $AGENT, to earn new tokens from selected AI+Crypto projects on AgentList. This process allows users to engage in the early stages of projects and receive rewards by locking up their assets for a specific duration. Once tokens are staked, users will receive regular rewards throughout the staking period. When the staking period ends or users choose to withdraw, they can unstake their tokens and claim the rewards, taking into account any associated lock-up periods or conditions.

AgentList's selection process involves several key steps:

Quality Assessment: A comprehensive evaluation is conducted to assess the accuracy, relevance, and impact of the AI Agent Assets considered for listing on the platform.

Community Input: The AgentLayer community actively participates in the review and voting process for AI Agent Assets, providing valuable insights and feedback.

Fundraising Support: Selected AI Agent projects have the opportunity to participate in fundraising events hosted by AgentList. These events serve as a platform for projects to secure resources and gain visibility within the AgentLayer ecosystem.

By following these steps, AgentList ensures a robust selection process that involves quality assessment, community engagement, and fundraising opportunities for AI+Crypto projects within the AgentLayer protocol's ecosystem.

AgentLayer - Building a Decentralized, Equitable and Transparent AI Co-creation Ecosystem

AgentLayer is a decentralized AI protocol dedicated to establishing a decentralized, equitable, and transparent AI ecosystem where individuals can actively engage in AI creation and utilization. This platform facilitates the development of future multimodal autonomous AI entities, enabling users to easily craft and personalize their AI applications like chatbots, language learning assistants, and image generation tools through simple natural language interactions. By integrating private large language models (LLMs) and implementing sustainable crypto economic incentives, AgentLayer fosters a fair and open environment for AI creation.

By combining various modalities like text, speech, and images, AgentLayer enhances the richness of AI content and improves user experiences. Through a codeless creation approach, it eliminates traditional programming barriers, enabling broader user participation in AI content creation. Moreover, AgentLayer's token incentive mechanism ensures the sustainable operation and development of the Agent developer ecosystem by providing economic incentives for both developers and users.

AgentLayer is designed to reduce the barriers to entry and foster collaborative creation and active engagement between developers and users by offering token incentives. Through the introduction of a decentralized market mechanism, AgentLayer addresses issues of centralization and specialization in traditional AI models. Leveraging blockchain technology and the principles of Web3.0, AgentLayer expands opportunities and incentives for developers and users of intelligent systems.

Glossary of Terms

AgentChain

AgentLayer uses OP Stack and EigenDA to build AgentChain, a public blockchain enhancing coordination among AgentLink-powered agents

AgentEx

Gateway platform for discovering, investing in, and trading AI Agents

AgentFi

Feature allowing minting and trading AI Agents as assets

AgentLink

Protocols for agent communication, collaboration, and incentive sharing

AgentList

Launchpad platform supporting decentralized AI projects

AgentNetwork

Distributed trusted AI agent network for secure collaboration

AgentOS

Zero-code AI agent development and orchestration framework

Agent Store

Marketplace for buying, selling, and subscribing to AI Agents

Agent Layer SDK

Development kit for AI Agents to interact with blockchain networks

AMM Mode

Automated Market Maker mode for instantaneous and liquid transactions

Auction Mode

Buying Agent rights through bidding for fair price competition

Base Container

Standard runtime environment for AI Agents

Blockchain Data

Direct access to transaction history, ledger states, and smart contract states

CAA Keys

Utility tokens for accessing Character AI Agents and related activities

Character AI Agent

AI Agents designed for knowledge workers and professionals

Container Engine

Independent execution environment for AI Agents

Deposit Requirement

Locking a deposit per Agent instance on the blockchain

Deposit Release

Incentivized deposit return at the end of a service lifecycle

LLM API

Integration of large language models for complex AI tasks

Malicious Behavior Handling

Mitigating deviations from designated code by malicious Agent instances

ModelHub

Collection of open-source state-of-the-art Language Models

Node Operation

Management of nodes running Agent instances

Secure Communication

Independent and secure communication between Agent instances

Service Lifecycle

Period during which an Agent instance operates before deposit release

Smart Contract Calls

Interacting with smart contracts by AI Agents

Subscription Mode

Customizable service selection based on permissions, prices, and terms

Task-specific AI Agents

AI Agents designed for specific tasks and sold as NFTs

Trusted Agent

Designation for reliable AI Agents within AgentNetwork validated by Agent AVS

Agents Collaboration Pool

Reward pool for collaborative Agent development

Basic Prompt Framework

Standardized interface for generating AI Agent prompts

Fraud Proofs

Evidence submitted to penalize misconduct among AI Agents

Misconduct Punishment

Reducing deposits of malicious Agent instances on the blockchain

Reference

Vitalik. (2024, January 30). The promise and challenges of crypto + AI applications. Retrieved from https://vitalik.eth.limo/general/2024/01/30/cryptoai.html

Pantera Capital. (2024, January 16). The Year Ahead. Blockchain Letter. Retrieved from https://panteracapital.com/blockchain-letter/the-year-ahead-2024/

JieXuan Chua, CFA, Moulik Nagesh, Shivam Sharma, Brian Chen. "Full-Year 2023 & Themes for 2024." January 2024. [Online]. Available: https://public.bnbstatic.com/static/files/research/full-year-2023-and-themes-for-2024.pdf

Mason Nystrom. "Crypto AI Agents: The First-Class Citizens of Onchain Economies." [Online]. Available: https://www.masonnystrom.com/p/crypto-ai-agents

Autonomous AI and Autonomous Agents Market by Offering (Hardware, Software (Type (Computational Agents, Robotic Agents)) and Services), Technology (ML, NLP, Context Awareness, Computer Vision), Vertical and Region - Global Forecast to 2028. (2023, June). Retrieved from https://www.marketsandmarkets.com/Market-Reports/autonomous-ai-and-autonomous-agents-market-208190735.html

LLM4Vuln: A Unified Evaluation Framework for Decoupling and Enhancing LLMs’ Vulnerability Reasoning https://arxiv.org/pdf/2401.16185.pdf

Last updated